Exactly How VA Home Loans Make Homeownership Affordable for Veterans

Exactly How VA Home Loans Make Homeownership Affordable for Veterans

Blog Article

Browsing the Home Loans Landscape: Just How to Leverage Financing Solutions for Long-Term Wealth Structure and Protection

Navigating the complexities of home mortgage is essential for any person aiming to construct wealth and ensure economic protection. Comprehending the various kinds of funding options readily available, in addition to a clear evaluation of one's financial situation, lays the foundation for notified decision-making. By utilizing calculated borrowing techniques and preserving residential or commercial property value, people can boost their lasting riches potential. The details of properly using these options raise critical inquiries regarding the best methods to adhere to and the mistakes to stay clear of. What techniques can absolutely maximize your financial investment in today's unstable market?

Understanding Home Car Loan Kinds

Home loans, an important component of the real estate market, can be found in various kinds created to fulfill the diverse needs of consumers. The most typical types of home mortgage include fixed-rate home loans, variable-rate mortgages (ARMs), and government-backed finances such as FHA and VA financings.

Fixed-rate home loans supply stability with consistent month-to-month settlements throughout the loan term, normally ranging from 15 to 30 years. In comparison, ARMs feature passion rates that fluctuate based on market conditions, frequently resulting in reduced initial settlements.

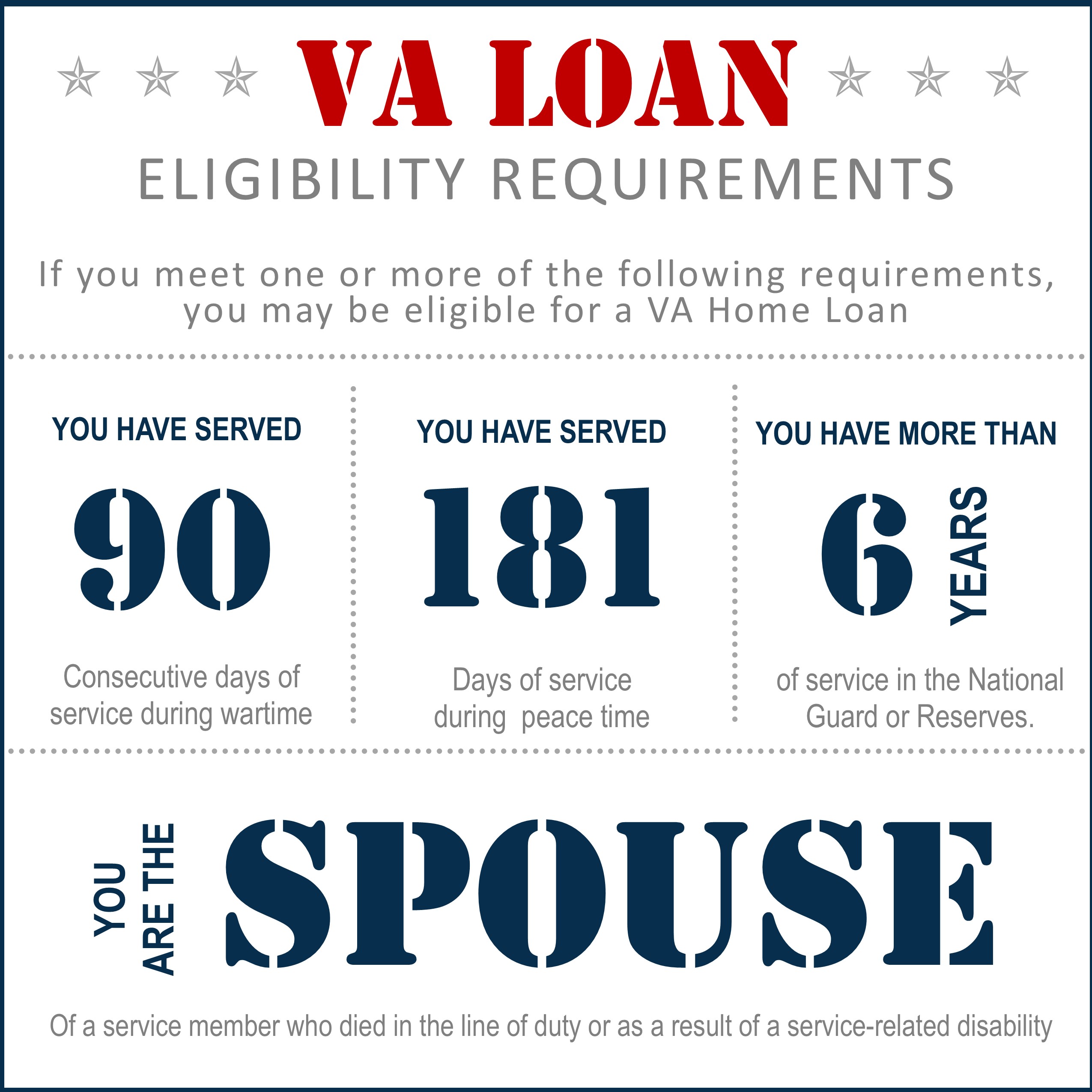

Government-backed finances, such as those insured by the Federal Real Estate Administration (FHA) or assured by the Department of Veterans Affairs (VA), satisfy certain groups and often call for lower deposits. These financings can assist in homeownership for people who may not get approved for standard financing.

Assessing Your Financial Situation

Examining your financial situation is an important action in the home mortgage procedure, as it lays the structure for making notified borrowing choices. Begin by evaluating your revenue sources, consisting of incomes, benefits, and any type of additional profits streams such as rental properties or investments. This comprehensive sight of your incomes helps lenders determine your borrowing capacity.

Next, analyze your costs and regular monthly obligations, consisting of existing financial obligations such as charge card, trainee car loans, and vehicle payments. A clear understanding of your debt-to-income proportion is vital, as many lenders prefer a proportion below 43%, guaranteeing you can handle the new mortgage payments along with your present obligations.

In addition, examine your credit history, which substantially influences your funding terms and passion prices. A greater credit report shows financial dependability, while a reduced score might necessitate methods for improvement prior to applying for a loan.

Last but not least, consider your properties and savings, consisting of emergency situation funds and fluid investments, to guarantee you can cover deposits and shutting costs. By diligently assessing these components, you will certainly be better positioned to browse the mortgage landscape effectively and secure funding that aligns with your long-lasting economic goals.

Techniques for Smart Loaning

Smart loaning is important for navigating the intricacies of the mortgage market effectively. To optimize your borrowing method, start by understanding your credit scores account. A solid credit rating can considerably reduce your rates of interest, translating to considerable financial savings over the life of the funding. On a regular basis monitoring your credit score report and dealing with discrepancies can enhance your score.

Following, take into consideration the type of home loan that ideal suits your monetary scenario. Fixed-rate fundings supply stability, while variable-rate mortgages may offer lower first repayments yet bring risks of future rate rises (VA Home hop over to these guys Loans). Evaluating your long-term plans and economic ability is crucial in making this decision

In addition, goal to protect pre-approval from loan providers before house searching. This not only offers a clearer photo of your budget plan yet likewise reinforces your negotiating placement when making an offer.

Long-Term Wide Range Structure Strategies

Structure long-term wide range through homeownership calls for a critical method that exceeds merely protecting a home mortgage. One reliable technique is to think about the appreciation capacity of the residential or commercial property. Choosing homes in expanding neighborhoods or locations with prepared growths can result in substantial boosts in property value with time.

One more crucial facet is leveraging equity. As home loan payments are made, property owners construct equity, which can be touched right into for future financial investments. Making use of home equity car loans or lines of credit report intelligently can give funds for added realty financial investments or restorations that additionally improve property value.

Moreover, keeping the home's problem and making critical upgrades can considerably add to lasting riches. When it comes time to market., straightforward renovations like up-to-date shower rooms or energy-efficient home appliances can yield high returns.

Last but not least, understanding tax obligation advantages related to homeownership, such as home mortgage interest reductions, can boost economic outcomes. By making the most of these benefits and embracing an aggressive investment mindset, homeowners can grow a durable portfolio that cultivates lasting wide range and security. Eventually, an all-round method that prioritizes both residential property option and equity monitoring is important for sustainable riches structure via actual estate.

Keeping Financial Safety

Moreover, fixed-rate home loans provide predictable monthly payments, enabling much better budgeting and financial preparation. This predictability safeguards home owners from the variations of rental markets, which can lead to sudden rises in housing costs. It is essential, nonetheless, to guarantee that home mortgage payments continue to be manageable within the wider context of one's monetary landscape.

Furthermore, accountable homeownership includes routine maintenance and renovations, which protect building worth and boost total safety and security. Home owners ought to additionally think about expanding their monetary portfolios, making certain that their investments are not only tied to genuine estate. By combining homeownership with various other financial tools, people can develop a well balanced technique that mitigates dangers and enhances general financial security. Eventually, preserving economic security through homeownership calls for a aggressive and enlightened technique that stresses careful planning and continuous persistance.

Final Thought

In conclusion, successfully browsing the home loans landscape requires a thorough understanding of numerous financing kinds and a detailed evaluation of specific financial circumstances. Carrying out tactical loaning practices promotes long-term wide range build-up and protects financial security. By preserving residential property worth and sensibly making use of equity, homeowners can produce chances for more investments. Ultimately, informed decision-making in financing services lays a robust structure for enduring riches and monetary safety.

Navigating the intricacies of home fundings is essential for anybody looking to develop riches and make certain monetary safety and security.Assessing your monetary situation is a crucial action in the home loan process, as it lays the foundation for making informed borrowing decisions.Homeownership not only serves as a car for long-lasting wide range structure yet additionally plays a considerable role in maintaining financial security. By combining homeownership with various other economic instruments, people can produce a well balanced strategy that minimizes dangers and improves total monetary security.In final thought, efficiently browsing the home lendings landscape requires an extensive understanding of different lending kinds and a detailed evaluation of individual economic scenarios.

Report this page